Tetsuo Furukawa of Japan published the book titled ‘Bubble Research: Economics of Greed’ (バブルの研究: 欲望の経済学), in which he explores how human greed is the root cause of economic bubbles.

‘Whether it’s a bubble or something else, if you look at where problems arise, the cause is always human desire and needs. If everyone could live moderately, we all could be happy, but that wasn’t understood at the time.’

If there is a wrong historical fact, whether in economics or humanities, it should be seen as an opportunity for learning through diverse thoughts and research. However, problems caused by human desires cannot simply be put to sleep. Hasn’t it been said that selfish human desires are the driving force behind economic growth? Of course, it is human ‘greed’ that creates bubbles in uncertainty. Not everyone shows the same level of greed. The greedier ones choose greater risks for higher returns. They should pay the price for their greed themselves. The real problem is the inability to pay that price. Debt, that is, playing greedy games with other people’s money, is the reason.

After achieving remarkable economic growth since the 19th century, various crises have occurred around the world, always accompanied by bubbles. However, the real issue with bubbles is actually debt. Without debt, bubbles could naturally serve as a market adjustment mechanism. An imbalance on one side is always occurring in an imperfect world. One cannot create shower water at the perfect temperature in one go. One adjusts hot and cold water to produce the desired temperature. In places where humans live together, by the time such water is made, other variables act, creating new phenomena.

Of course, the increase in debt was underlain by an imperfect monetary system and an excessively skewed power imbalance. Having a leader in the world’s financial markets, like elsewhere, can increase efficiency. However, excessive imbalance eventually leads to destruction and demands a new system. The history of nations, industries, and companies has been repeating in this manner. The imbalance of power between nations and the enormous size of the financial industry and financial institutions have also caused inequality.

The crises we encounter are not all the same. However, it is clear that an economic crisis in one country is not confined to that country alone. And during these crises, economists and bureaucrats from various countries begin to grow wiser. This is not to say they have some great solution. They just know what the effects of policies are and what costs must be incurred to achieve those effects. There are no cost-free policies. It’s only about how precisely and swiftly one can respond. The cost must be paid. The hope is that when the time comes to pay the cost, positive market changes will occur.

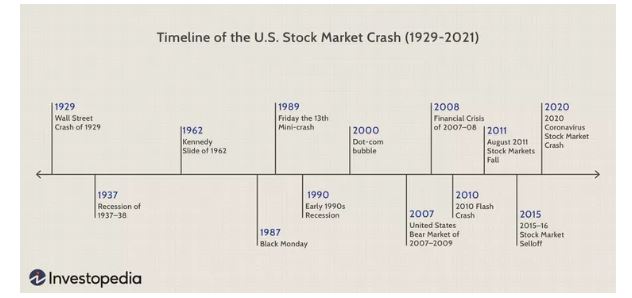

Even the masters of economics cannot predict the future accurately. That’s why we call this world a complex system. Predict one thing, and another changes, altering the predicted variable. Nonetheless, by reviewing past economic crises, their causes, and processes, we might be able to form our own opinions about future economies.

We plan to examine the crises that occurred in the United States, Japan, South Korea, and again in the United States, in chronological order. And to understand these historical facts, let’s utilize the knowledge we have reviewed so far.