Many people are predicting that 2024 will be the inaugural year for the activation of fractional investment. Indeed, the fractional investment market, including STO (Security Token Offering), began to surge rapidly after the Financial Services Commission announced the guidelines for security-type tokens in February last year. Eventually, by the end of last year, it emerged as a theme in the stock market. The atmosphere until January 2024 was reminiscent of the fervor for B2B commerce that blew with the start of the new millennium in 2000. New startups dreaming of pioneering new markets with new business ideas, as well as giant securities companies not wanting to miss out on the opportunity, are continuing to form alliances and strategies to increase their influence.

January 2024 saw the official commencement of investor recruitment as the securities issuance applications submitted by art fractional investment companies were approved. The physical securities issued based on art assets, leading the fractional investment market, served as a testing ground that could hint at the future success or failure of STOs. Although the current form of issuance of art investment securities is all physical securities that have completed the securities declaration, they are practically no different from ST (Security Tokens). The Financial Services Commission has compared conventional and unconventional securities to food, and the form of issuance to the container. This means that the basic asset, which is like food, can be placed in various containers such as physical securities, token securities, and digital securities. Changing the container does not change the taste of the food.

However, the January performance of the fractional investment companies that actually took the test in this testing ground does not look very good. Although the subscription event seemed to be a hit thanks to the anticipation for the opening of the fractional investment market, there were also cases of forfeited shares, where investors gave up their subscriptions, and under-subscription, where the subscription volume was not even filled.

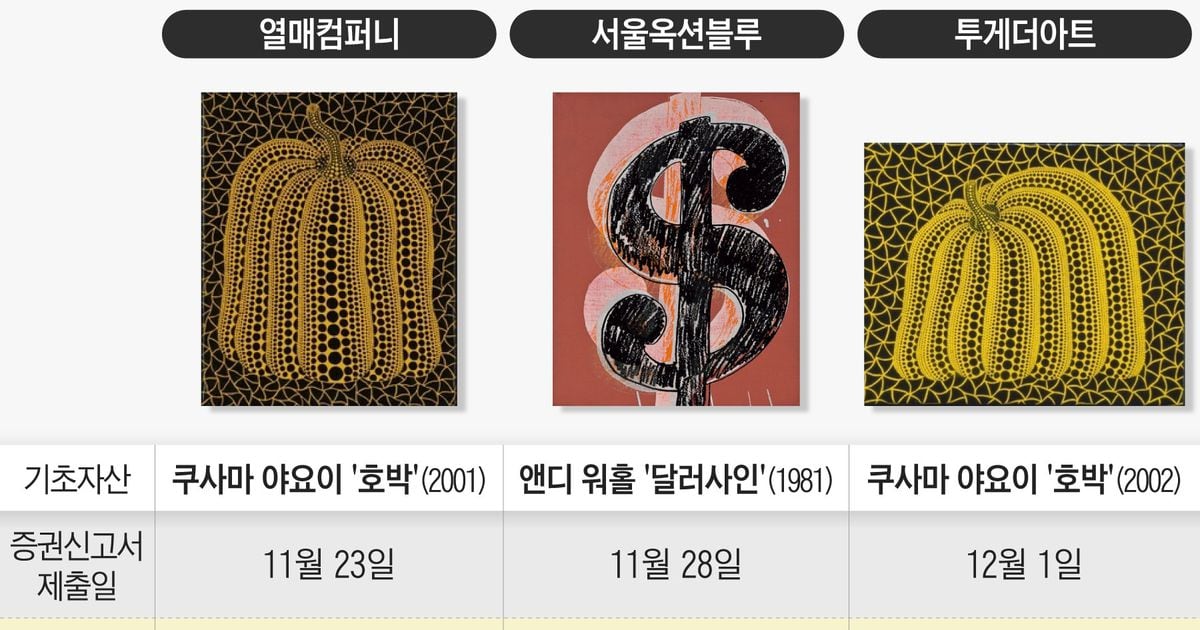

The securities based on Yayoi Kusama’s ‘Pumpkin’ by YEOLMAE Company garnered attention as the first public offering of investment contract securities, causing the subscription itself to be a hit. The offering of 1.188 billion won attracted 7.2057 billion won, resulting in a subscription competition ratio of 6.5 to 1. However, 82% of the general subscription volume was allocated proportionally, and 18% resulted in forfeited shares. The second contender, Seoul Auction Blue’s investment contract securities based on Andy Warhol’s ‘Dollar Sign’ as the underlying asset, faced an under-subscription crisis. Out of the total 700 million won, they aimed to raise 630 million won from investors, but the actual subscription amount was only 538.5 million won, making the subscription rate 85.4%, under-subscribed overall.

Forfeited shares refer to the shares allocated to shareholders during a paid-in capital increase that the shareholders did not subscribe to. Essentially, it means that about 18% of subscribers gave up on their subscriptions. As a result, Fruit Company had 18%, Seoul Auction Blue 13%, and Together Art 4% of forfeited shares.

Ultimately, the art fractional investment subscription failed to sell out. The biggest reason for this failure is likely liquidity issues. Currently, there is no market for trading the securities issued for fractional investment, making them less attractive investment options for investors in terms of liquidity. The lack of a trading platform essentially means that it is difficult to liquidate or cash out. For a fractional investment securities market to be established, amendments to the Capital Market Act and the Electronic Securities Act are required, but currently, the amendment bills are pending in the National Assembly.

Despite such circumstances, efforts to dominate the market continue in the industry. Koscom has entered into an agreement with Daishin Securities to conduct a pilot project for a token securities platform. In addition, KB Securities, Shinhan Investment Securities, and NH Investment Securities are also known to be building infrastructure for the STO market.

Chosun Ilbo’s February 10th article titled ‘Under-subscription, Under-subscription, Under-subscription… Why Securities Firms Don’t Stop Despite the Struggles of Art Fractional Investment’ analyzes their moves, which may seem similar but have different underlying motivations, dividing their strategies and goals into three types.

Firstly, Mirae Asset Securities established a practical working group called the Security Token (ST) Working Group, separate from the consortium for its ‘Next Finance Initiative (NFI)’. This group includes K-content producers, investment firms, fractional investment platforms, and comprehensive blockchain technology companies. According to a Chosun Ilbo article, this move was analyzed as an aggressive strategy to secure as many ‘basic assets’ as possible. In contrast, Korea Investment Securities, part of Korea Investment ST Friends, seems to be employing a strategy focused on attracting the maximum number of ‘investors’, as evidenced by incorporating leading internet banks like Kakao Bank and Toss Bank into the consortium at once.

The last mentioned group includes a coalition of KB Securities, NH Investment & Securities, and Shinhan Investment Corp. These firms appear to be focusing initially on refining infrastructure and business models rather than on investors and basic assets. They are reportedly working on cost efficiency and constructing a shared distributed ledger as part of their strategy to establish industry standards and lead the market.